A/P IRS 1099 Forms

This option is taken to Print (or view on the screen) IRS 1099 Forms for all or selected vendors at the end of the calendar year. A 1099 will be printed for each for whom you have entered a Federal I.D. Number (or Social Security Number) and whose Vendor Paid YTD amount is greater than the Minimum Dollar Amount specified.

This option should not be taken until all checks written in the last month of the calendar year have been posted.

NOTE: If you intend to print 1099's, you must print them before posting any new checks written in the new year and Vendor 1099 zeroing for the current year.

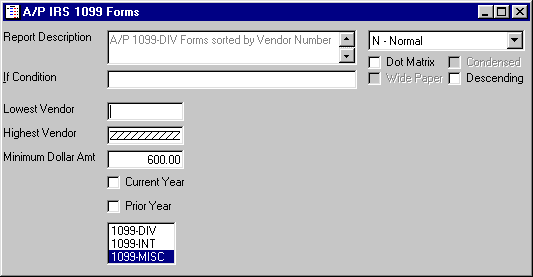

After selecting this option from the A/P Reports Menu, the computer will display the screen as follows:

NOTE: Donít forget to Insert and align the proper 1099 forms in the printer. (Refer to the Recommended Supplies list for the specifications of the type of forms compatible with this program.)

Enter the Minimum Dollar Amount for these forms. You may specify a range of Vendors. Select the Type of 1099 form you will be printing.

If you wish to print dummy forms to determine if the 1099s are properly aligned in the printer, select the Dummy Form icon. A dummy 1099 will then be printed using X's for data. You may print as many dummy forms as necessary. When you are ready to print the 1099s, click on the Accept icon on the Toolbar, pick the Accept option from the File Menu, or press [Ctrl][A]. If you do NOT wish to proceed, click on the Cancel icon on the toolbar, pick the Cancel option from the File Menu, or press [Ctrl][L].

NOTE: Donít forget to insert and align paper in the printer when you are done printing 1099s.