A/R Tax Code Maintenance

This option is taken to initially create the TAX CODE file and then to add new codes or make changes as necessary to codes currently existing in the file.

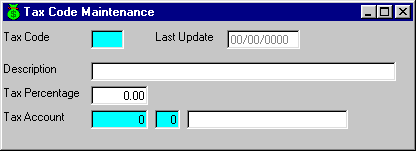

After selecting this option from the A/R Master File Maintenance Menu, the computer will display the Tax Code Maintenance screen as follows:

A) To add a new Tax Code to the file, enter the new, unused Tax Code that you are assigning and press [TAB]. Tax Codes are 3 characters in length.

B) To view/change an existing Code's information, enter the Tax Code of the record you wish to change, or Perform A Search to find a Tax Code record. After entering a valid Code, the information stored for that code will be displayed.

Enter the Description for this Tax Code.

Enter the Tax Percentage for this Tax Code. This field will be used to calculate the Sales Tax Amount on invoices.

Enter the Tax Account (G/L Account number and department) for this Tax Code (or Perform A Search to find one). The description will be displayed for verification. This account should be your Sales Tax Payable account.

Review the data you have entered (or changed) on the screen. If you wish to SAVE the information, click on the Save button on the Toolbar, pick the Save option from the File Menu, or press [Ctrl][S]. If you do NOT wish to save the information, click on the Cancel button on the toolbar, pick the Cancel option from the File Menu, or press [Ctrl][L].