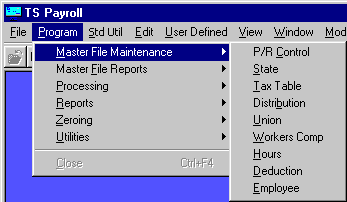

P/R Master File Maintenance Menu

The P/R Master File Maintenance Menu includes options for setting up all of the master files needed for Payroll processing. The master files in the Payroll system are:

P/R CONTROL - default G/L Numbers, Federal I.D. Number, 941 information

STATE - tax and unemployment information for all taxing agents (Federal, State, and Local)

TAX TABLE - graduated Federal tax tables (State and Local when applicable)

HOURS CODE - types of pay (regular, overtime, salary, sick, vacation, etc.)

DEDUCTION CODE - non-tax deductions (savings, pension, insurance etc.)

DISTRIBUTION - payroll breakdowns (job function, branch office, responsibility)

WORKMEN'S COMP - Workmen's Compensation levels/rates and limits

PUBLIC LIABILITY - public Liability levels/rates and limits

UNION - union descriptions and hourly union dues amounts

EMPLOYEE - personal data, exemptions, deductions, MTD QTD and YTD wages, and tax withholdings

After the initial set-up information has been entered into the individual Master files, options on this menu will only be used when it is necessary to change information in a file or add a new record.

From the Program Menu, select Master File Maintenance to display the menu as follows.