G/L Chart Of Accounts Maintenance

This option is used to initially enter vendors into the VENDOR MASTER file, add new vendors, or make changes as necessary to Vendor Master information currently existing in the file.

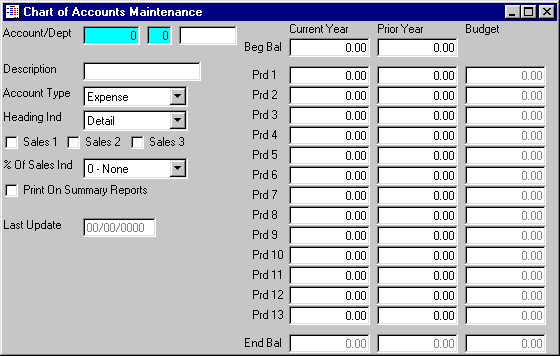

After selecting this option from the G/L Master File Maintenance Menu, the computer will display the G/L Chart Of Accounts Maintenance screen as follows:

A) To add a new Account to the file, enter the unique Account/Dept (Account and Department) that you are assigning to this account and press [TAB].

B) To view or change an existing Account's information, enter the Account/Dept (Account and Department) of the account whose record you wish to change, or Perform A Search to find an Account record. Upon entering a valid number, the computer will display the master information stored for this account. Make changes in the same manner you entered the data.

Enter the Remaining information on this screen as follows:

Enter the Description of this account.

The Account Type field allows you to enter the type of account assigned to this account number. You can display the available options by clicking this field with your mouse or scrolling through the list by using the up/down arrow keys. Accounts with the Asset or Liability account type will appear on the G/L Balance Sheet. Accounts with the Asset or Liability account type will appear on the G/L Income Statement.

The Heading Ind (Indicator) field allows you to enter the type of heading assigned to this record. You can display the available options by clicking this field with your mouse or scrolling through the list by using the up/down arrow keys. An explanation of the different heading indicators are:

Major Heading – These accounts print major headings on the financial reports and will have no entry activity in it. Some examples of these types of accounts are ASSETS, LIABILITIES and EQUITY, INCOME, and EXPENSE.

Heading - Minor – These accounts print minor headings on the financial reports and will have no entry activity in it. Some examples of these types of accounts are CURRENT ASSETS, CURRENT LIABILITIES, and SALES INCOME, OTHER INCOME, SELLING EXPENSES and OPERATING EXPENSES.

Detail – These accounts have General Ledger activity in it on an ongoing basis; they are the only type of accounts that have information posted to them and carry a balance. Some examples of this type of account would be CASH, ACCOUNTS PAYABLE, TAXABLE SALES, and ADVERTISING EXPENSE.

Profit – These accounts are the profit accounts and they represent a computer calculated number that is the difference between debits and credits on both financial statements. Two profit accounts should be established, the Balance Sheet account may be named similar to CURRENT YEAR INCOME and the Income Statement account NET PROFIT OR LOSS.

It is very important that these profit accounts are given G/L Numbers in the correct numbering sequence. The Balance sheet profit account should be assigned an Account Number positioned just before the final totals of Equity (its Account Number should precede the TOTAL STOCKHOLDERS EQUITY or TOTAL CAPITAL Account Number). The Income Statements profit account's Account Number should be assigned so that it will be the last account on the Income Statement. (This account will have the highest Number.)

5 – Total (least) through 9 – Total (most) – Accounts with these indicators (5, 6, 7, 8 or 9) are subtotal accounts. Consider the subtotal accounts to be different levels of subtotals, where the smaller the indicator, the smaller the level of the subtotal. When printing a financial statement, the computer will accumulate a total of normal (HEADING indicator = 3) accounts until it reaches an account with a subtotal indicator. At this point, it will print a total of all normal, 3, accounts since the last subtotal indicator it reached. After printing this subtotal, the subtotal accumulator for that indicator is zeroed out, along with all previous lower subtotal indicators, and accumulating begins again until the next subtotal indicator is reached.

To illustrate how the subtotal indicators function, suppose the ASSET section of the Balance Sheet is structured as follows (HEADING indicators in parentheses):

ASSETS (Major Heading)

Current Assets (Heading - Minor)

Cash (Heading - Minor)

Cash In Bank #1 1,000.00 (Detail)

Cash In Bank #2 2,000.00 (Detail)

Petty Cash 250.00 (Detail)

Savings Bank #1 10,000.00 (Detail)

Total Cash 13,250.00 (5 - Total)

Accounts Receivable 5,075.00 (Detail)

Notes Receivable 4,000.00 (Detail)

Total Current Assets 22,325.00 (6 - Total)

: : :

: : :

TOTAL ASSETS 1,750,000.00 (7 - Total)

When the computer reaches the TOTAL CASH account (whose indicator is 5 - Total), the accounts CASH IN BANK #1, CASH IN BANK #2, PETTY CASH, and SAVINGS BANK #1 are totaled; this total is printed next to TOTAL CASH. Then the 5 - Total indicator is reset to 0 so it may begin accumulating again until the next 5 - Total indicator is reached.

When the computer reaches the TOTAL CURRENT ASSETS account (whose indicator is 6 - Total), all the Detail accounts since the last 6 - Total indicator (in this case all accounts in the CURRENT ASSETS section) are totaled with the total printed next to TOTAL CURRENT ASSETS. Then the 6 - Total indicator (along with the 5 - Total indicator) is reset to 0 so it may begin accumulating again until the next 6 - Total indicator is reached.

The Sales 1 – 3 boxes may be selected if you wish to include this account in the respective sales totals (for income and expense accounts only). This field is used to calculate a total that the computer will use to create the percentage of sales on the G/L Income Statement. For example, you may wish to have a Sales 1 that accumulates all the accounts that calculate the Total Sales and a Sales 2 that accumulates all the accounts that calculate the Gross Profit.

The % of Sales Ind (indicator) field allows you to enter what type of percentage will be used for this account number. You can display the available options by clicking this field with your mouse or scrolling through the list by using the up/down arrow keys. The valid entries are 0 – None (no percent of sales calculated), 1, 2, and 3. For example, if Sales 1 equals the Total Sales and Sales 2 equals the Gross Profit, you might mark all the sales accounts with 1 (to show these accounts as a percent of Totals Sales) and all other accounts with a 2 (to show these accounts as a percent of Gross Profit).

The Print On Summary Report box may be selected if you want this account to be included on a summarized financial statement. When printing a G/L Balance Sheet or G/L Income Statement, you have the ability to include all accounts or print a summarized report with only selected accounts. When this box is selected the computer will include this account on the summarized financial statements. (The computer will default this box depending on the heading indicator you entered.)

The Last Update field indicates the last time master information for this account was changed. The software will maintain this date.

The remaining fields are automatically updated by the computer when journal entries are posted. Leave these fields blank when entering a new vendor. When you are initially setting up your general ledger system, you may need to enter the Beg Bal, Current Year Beginning Balances for the Balance Sheet accounts (Account Type of Assets or Liabilities).

Review the data you have entered (or changed) on the screen. If you wish to SAVE the information, click on the Save button on the Toolbar, pick the Save option from the File Menu, or press [Ctrl][S]. If you do NOT wish to save the information, click on the Cancel button on the toolbar, pick the Cancel option from the File Menu, or press [Ctrl][L].