P/R Control File Maintenance

The P/R CONTROL file stores default values for special information which applies to processing for the P/R system. This option is used to initially enter the data in the P/R CONTROL file and then to make changes to the default values as needed.

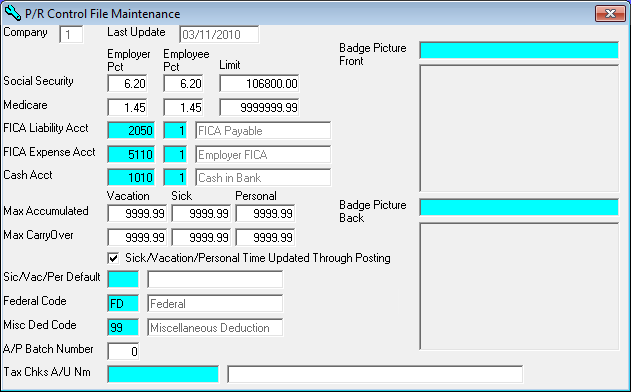

After selecting this option from the P/R Master File Maintenance Menu, the P/R Control File Maintenance screen will be displayed as follows:

Enter the Social Security information as follows, enter the Employer Pct. (employer percent) (to enter 6.20%, type 6.20) followed by the Employee Pct. (employee percent) and finally enter the dollar Limit (when an employee's YTD Gross Income reaches this limit, social security taxes will no longer be deducted for that employee for the remainder of the year).

Enter the Medicare information as follows, enter the Employer Pct. (employer percent) followed by the Employee Pct. (employee percent) and finally enter the dollar Limit (when an employee's YTD Gross Income reaches this limit, medicare taxes will no longer be deducted (for that employee) for the remainder of the year).

Enter the FICA Liability Acct (G/L account number and department), or Perform A Search to find a record, for the employer and employee FICA liability account

Enter the FICA Expense Acct, or Perform A Search to find a record, for the employer's FICA contribution

Enter the Cash Acct, or Perform A Search to find a record, for the cash/checking account used for payroll checks.

Enter the Max Accumulated (maximum accumulated) hours of Vacation, Sick, and Personal that an employee may accumulate for a calendar year.

Enter the Max CarryOver (maximum carry over) hours of Vacation, Sick, and Personal that an employee may carry forward from a previous year.

Check the Sick/Vacation/Personal Time Updated Through Posting option if you want to update sick/vacation/personal time through the posting program instead of the YTD Zeroing.

Enter the Sic/Vac/Per Default (sick/vacation/personal code default) (or Perform A Search to find one). (You may leave this blank if no default is necessary.)

Enter the Federal Code (or Perform A Search to find one). (This code is always FD.)

Enter the Misc Ded Code (miscellaneous deduction code) (or Perform A Search to find one). (This code is usually 99.)

If you are using the 941 Tax Check Printing option in payroll, you must enter the A/P Batch Number (which should be a unique batch number that is currently never used in accounts payable) and Tax Chks A/U Nm (tax checks autopilot name) (or Perform A Search to find one).

Enter the Badge Picture Front (or Perform A Search to find one). This picture will be printed on the front of an Employee Badge. A picture of the specified graphic will be displayed if this field is entered properly.

Enter the Badge Picture Back (or Perform A Search to find one). This picture will be printed on the back of an Employee Badge. A picture of the specified graphic will be displayed if this field is entered properly.

Review the data you have entered (or changed) on the screens. If you wish to SAVE the information, click on the Save button on the Toolbar, pick the Save option from the File Menu, or press [Ctrl][S]. If you do NOT wish to save the information, click on the Cancel button on the toolbar, pick the Cancel option from the File Menu, or press [Ctrl][L].