P/R Deduction Code Maintenance

This option is used to initially create records in the DEDUCTION MASTER file for any deductions from employee's pay other than federal, state and local taxes (for example insurance, savings, pension, etc.). When setting up specific deductions, you have the ability to indicate in which pay periods the deductions should be made and also whether the deductions are a flat amount or a percentage of gross pay.

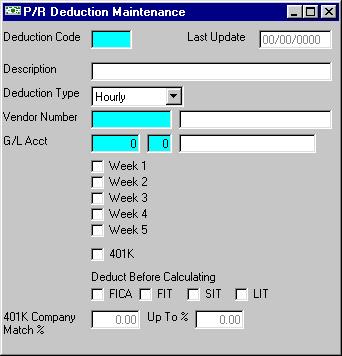

After selecting this option from the P/R Master File Maintenance Menu, the P/R Deduction Code Maintenance screen will be displayed as follows:

A) To add a new record to the file, enter the unique Deduction Code that you are assigning to this record and press [TAB].

B) To view or change an existing record's information, enter the Deduction Code of the record you wish to change, or Perform A Search to find a record. Upon entering a valid number, the computer will display the master information stored for this record. Make changes in the same manner you entered the data.

Enter a Description for this code.

Select a Deduction Type for this code, which will determine the whether it is Hourly (the amount setup in the EMPLOYEE MASTER file will be multiplied by the total hours for the timecard), Amount (the amount setup in the EMPLOYEE MASTER file will be used as the deduction amount for the timecard), or Percent (the amount setup in the EMPLOYEE MASTER file will be calculated as a percentage of gross for the timecard).

Enter the Vendor Number, or Perform A Search to find a record, if you wish to post deduction information to accounts payable.

Enter the G/L Acct (G/L account number and department), or Perform A Search to find a record, for the liability account for this deduction.

Check each Week (1-5) option box you want the deduction to be taken. For a weekly payroll in which you wish to take the deduction each week, answer [Y] to weeks 1-5. For a bi-weekly payroll in which you want deductions to be taken on every check, you would answer [Y] to weeks 1, 2, and 3 (in case there could be a third pay period in a month).

If this is a 401K deduction, click this check box.

If the deduction is to be taken before calculating taxes, please click the appropriate check box of FICA, FIT, SIT, and/or LIT.

If the deduction is to be taken Before Tax is computed, check this option box.

Enter the 401K Company Match % which is the percentage of 401K deducted from your employee's payroll check that the company will contribute. Next enter the Up To % which is the maximum percentage that the company will contribute for any 401K deduction. (These are only available if the 401K check box is selected.) Assuming the Company Match is 50% and Up To is 9%, then whatever the employee is deducting for their 401K, the company will contribute 50% of the deduction amount not to exceed 9% of the employee's total gross pay.

Review the data you have entered (or changed) on the screens. If you wish to SAVE the information, click on the Save button on the Toolbar, pick the Save option from the File Menu, or press [Ctrl][S]. If you do NOT wish to save the information, click on the Cancel button on the toolbar, pick the Cancel option from the File Menu, or press [Ctrl][L].