P/R Tax Table Maintenance

This option is used to initially create Federal and State Tax Tables for the TAX TABLE MASTER file and then to add new tables or make adjustments to the tables as necessary. Payroll processing bases tax calculations on the tax tables entered in this file. Records should only be added to this file for any tax (federal, state or local) which is on a graduated scale. Taxes that are a straight percentage will be set up in the STATE CODE file. Annual tax tables are needed for each Filing Status. For instance, Federal tables have already been set up in this file for Married and Single. You will need to enter State tax tables for each filing status that applies to your payroll.

NOTE: You are responsible for maintaining tax tables set-up in this file! Be sure that you enter any changes that occur due to changes in Federal, State or Local tax laws.

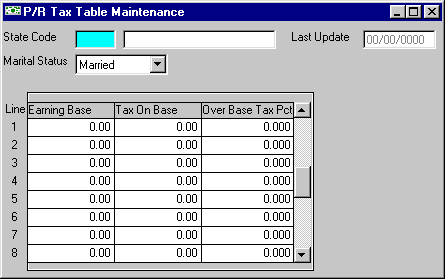

After selecting this option from the P/R Master File Maintenance Menu, the computer will display the Tax Table Maintenance screen as follows:

A) To add a new Tax Table to the file, enter the State Code and Filing Status for which you are creating a Tax Table (or Perform A Search to find a State record) and press [TAB].

B) To view or change an existing Tax Table's information, enter the State Code and Filing Status for the Tax Table you wish to change (or Perform A Search to find a State record). Upon entering a valid number, the computer will display the master information stored for this Tax Table. Make changes in the same manner you entered the data.

Enter the remaining information on this screen as follows:

To enter a new table, you will enter lines for each Earning Base, the Tax on (that) Base and Over Base Tax Pct (tax percentage on the amount over the earnings base up to the next earnings base).

To enter each line on the table, enter the Earning Base, the Tax on Base, and the Over Base Tax Pct.

If a portion of a tax table was as follows...

Over Base

Earning Base ($$) Tax on Base ($$) Tax Pct (%)

277.00 39.70 25.00

423.00 76.20 30.00

... and an employee had a gross pay of $400.00, the tax will be calculated as follows: a tax of $39.70 + [($400.00-$277.00) x .25] = $70.45.

Review the data you have entered (or changed) on the screens. If you wish to SAVE the information, click on the Save button on the Toolbar, pick the Save option from the File Menu, or press [Ctrl][S]. If you do NOT wish to save the information, click on the Cancel button on the toolbar, pick the Cancel option from the File Menu, or press [Ctrl][L].