P/R State Code Maintenance

This option is used to initially create records in the STATE MASTER file and then to add new items or make adjustments to the records as necessary. Since the STATE MASTER file holds tax and unemployment values for all taxing agents, records must be entered here for any type of tax (even if the tax will be calculated based on a tax table). Even if you do not have a state tax, you must enter a state record in this file. In addition, a record is needed for Federal (FD) tax and records are needed for any City County, and/or Local Taxes.

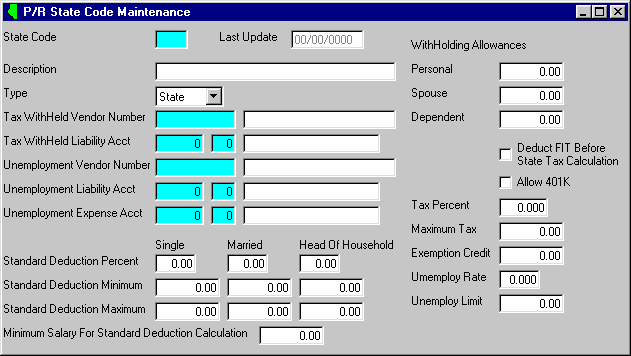

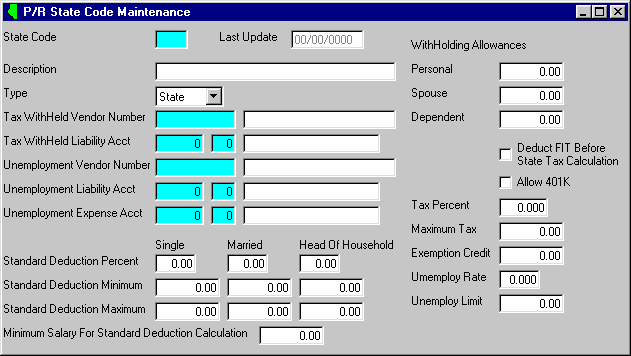

After selecting this option from the P/R Master File Maintenance Menu, the computer will display the State Code Maintenance screen as follows:

A) To add a new State to the file, enter the unique State Code that you are assigning to this state and press [TAB].

B) To view or change an existing State's information, enter the State Code of the state whose record you wish to change, or Perform A Search to find a State record. Upon entering a valid number, the computer will display the master information stored for this state. Make changes in the same manner you entered the data.

Enter the State Name.

Enter the Tax Withheld Credit G/L. This is the G/L Number for your liability account for this (federal, state, city, county) tax. Next, enter the Unemployment Debit G/L (expense account) and Unemployment Credit G/L (liability account) if there is unemployment withholding for this taxing agent.

If the taxing agent has a Standard Deduction, using the Calculate Standard Deduction table, enter the % of Slry (Salary) and Min. and Max. amounts for each filing status in the Calculate Standard Deduction table.

If there is a Min. Salary for Calculation of Standard Deduction, enter the amount in this field.

NOTE: If you are unsure if you need to use the Calculate Standard Deduction table, check your state tax booklet. It should indicate if a standard deduction is used.

The Standard Deduction is calculated as follows:

Standard Deduction = ( Yearly Salary - Minimum Salary for Calculation ) X ( % of Salary / 100 )

* If Standard Deduction < Minimum Amount then Std. Deduction = Minimum Amount

* If Standard Deduction > Maximum Amount then Std. Deduction = Maximum Amount

* If a Minimum Salary for a calculating a standard deduction is not used, it is not applied in the formula (assumed to be 00.00).

Enter the Exemption Amounts for Personal, Spouse and Dependent exemptions. Even if amounts are the same, enter them in the appropriate field.

The maximum number of personal exemptions an employee can have is 1. The maximum number of spouse exemptions a single employee can have is 1. Any exemptions entered (in the EMPLOYEE MASTER file) in excess of these maximum amounts are considered to be dependent exemptions. Therefore, when entering employee information (in the EMPLOYEE MASTER file), if you enter more than 2 exemptions for a married employee; when calculating deduction amounts, the computer assumes 2 exemptions at the Personal (and Spouse) amount and the remaining exemptions at the Dependent amount.

Enter the Tax Percentage if the tax is a straight percentage. Otherwise if the tax is calculated based on a table, leave this field blank - use the Tax Table Maintenance option on the P/R Master File Maintenance Menu option to enter the table for a graduated tax.

NOTE: If a Tax Percentage is not entered and there is not a tax table for the state, the computer assumes there is not state tax during payroll processing.

Enter the Unemployment Rate and Unemployment Limit for this tax. Only enter the percent for the rate.

The FIT Deduct Code is used to accommodate certain state tax calculations. If FIT is to be deducted before the calculation of this state’s tax, check this option box.

Review the data you have entered (or changed) on the screens. If you wish to SAVE the information, click on the Save button on the Toolbar, pick the Save option from the File Menu, or press [Ctrl][S]. If you do NOT wish to save the information, click on the Cancel button on the toolbar, pick the Cancel option from the File Menu, or press [Ctrl][L].