A/P To G/L Posting

This option is used to post A/P General Ledger entries to the G/L TEMPORARY file in the General Ledger module. It may be taken as often as you wish throughout the month, but must be completed at least once a month, after all the current period's Accounts Payable processing has been completed, and before completing the A/P Paid Invoice Reorganization option.

Posting takes place based on the type of Accounting method you selected in the A/P CONTROL file, and also whether you chose Detail or Summary posting. If you operate on a Cash basis, only expenses from paid invoices (including partial payments) are posted. If you operate on an Accrual basis, expenses from all invoices, both paid and unpaid, are posted. The Debit side of the journal entry originates from the G/L Numbers you entered when you originally entered invoices (using the Temporary Invoice Maintenance option on the A/P Processing Menu). The Credit side of the journal entry for unpaid invoices is typically your Accounts Payable account (set up in the A/P CONTROL file), and for paid invoices, is the Cash Account you entered when using the Check Posting option on the A/P Processing Menu.

If you selected Detail posting in the A/P CONTROL file, each detail G/L disbursement will be posted. If you selected Summary posting, expenses for each G/L Number are accumulated and a lump sum total for each G/L Number is posted.

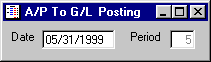

After selecting this option from the A/P Zeroing Menu, the computer will display the screen as follows: